Average G&A Rate For Small Business . One pool and rate can. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. general and administrative (g&a) expenses are grouped together into an overall g&a pool. even within the same industries, we find measurable gaps in g&a spending among competitors—as much as. grant thornton is pleased to provide our 2017 government contractor survey. In allocating the g&a indirect cost. General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. saas companies, especially small businesses that are scaling quickly, often have general and administrative. The report presents a wealth of financial and. for small business service providers, two indirect rates (overhead and g&a) are usually sufficient.

from www.braintree.gov.uk

The report presents a wealth of financial and. grant thornton is pleased to provide our 2017 government contractor survey. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. even within the same industries, we find measurable gaps in g&a spending among competitors—as much as. for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. One pool and rate can. In allocating the g&a indirect cost. general and administrative (g&a) expenses are grouped together into an overall g&a pool. General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. saas companies, especially small businesses that are scaling quickly, often have general and administrative.

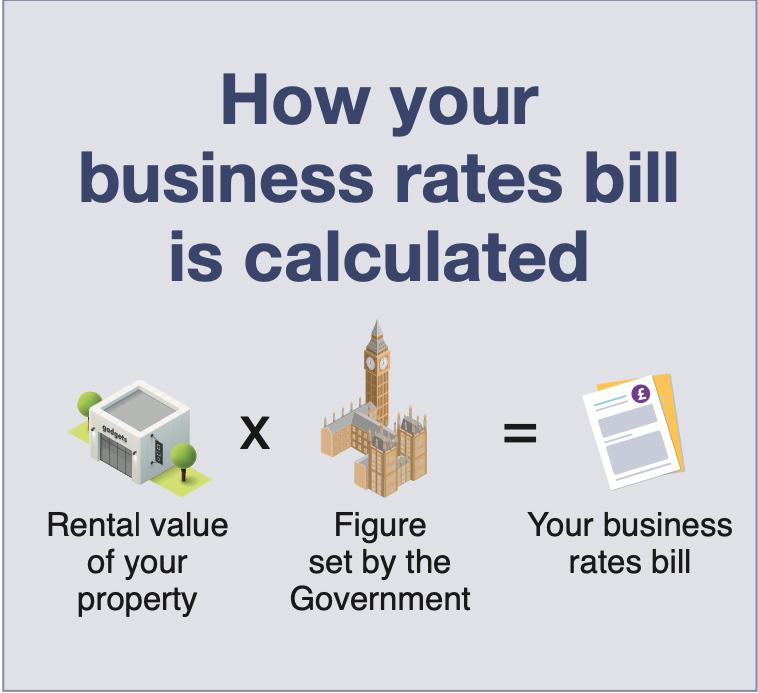

Page 1 Your guide to Business rates guide brochure 2022/23

Average G&A Rate For Small Business In allocating the g&a indirect cost. for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. general and administrative (g&a) expenses are grouped together into an overall g&a pool. One pool and rate can. grant thornton is pleased to provide our 2017 government contractor survey. General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. The report presents a wealth of financial and. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. even within the same industries, we find measurable gaps in g&a spending among competitors—as much as. In allocating the g&a indirect cost. saas companies, especially small businesses that are scaling quickly, often have general and administrative.

From ciowomenmagazine.com

What Is the Average Small Business Loan Interest Rates? 5 Basic Average G&A Rate For Small Business In allocating the g&a indirect cost. The report presents a wealth of financial and. One pool and rate can. even within the same industries, we find measurable gaps in g&a spending among competitors—as much as. for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. general and administrative (g&a) expenses are grouped together. Average G&A Rate For Small Business.

From www.smartinsights.com

Google Ads conversion rate averages by industry Smart Insights Average G&A Rate For Small Business One pool and rate can. saas companies, especially small businesses that are scaling quickly, often have general and administrative. General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. general and administrative (g&a) expenses are grouped together into an overall g&a pool. for instance, according to a mckinsey & company. Average G&A Rate For Small Business.

From merehead.com

What is an Average Marketing Budget for a Small Business with Breakdown Average G&A Rate For Small Business grant thornton is pleased to provide our 2017 government contractor survey. for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. saas companies, especially small businesses that are scaling quickly,. Average G&A Rate For Small Business.

From www.zippia.com

25+ Essential Small Business Lending Statistics [2023] What Percentage Average G&A Rate For Small Business for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. general and administrative (g&a) expenses are grouped together into an overall g&a pool. The report presents a wealth of financial and. One pool. Average G&A Rate For Small Business.

From www3.swipeclock.com

Using a PEO? Why it could make the difference between survival and Average G&A Rate For Small Business General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. saas companies, especially small businesses that are scaling quickly, often have general and administrative. for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. for starters, please fine below tables of indirect cost rate calculations for. Average G&A Rate For Small Business.

From luisazhou.com

The Percentage of Businesses That Fail (Statistics & Failure Rates) Average G&A Rate For Small Business for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. general and administrative (g&a) expenses are grouped together into an overall g&a pool. for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. for. Average G&A Rate For Small Business.

From www.finder.com

Business loan rates in 2021 SBA loans and more Average G&A Rate For Small Business One pool and rate can. grant thornton is pleased to provide our 2017 government contractor survey. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. saas companies, especially small businesses that are scaling quickly, often have general and administrative. general and administrative (g&a). Average G&A Rate For Small Business.

From equitablegrowth.org

The relationship between taxation and U.S. economic growth Equitable Average G&A Rate For Small Business General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. saas companies, especially small businesses that are scaling quickly, often have general and administrative. One pool and rate can. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top.. Average G&A Rate For Small Business.

From mozo.com.au

Why 2020 could be the best year to take out a business loan Average G&A Rate For Small Business for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. One pool and rate can. The report presents a wealth of financial and. In allocating the g&a indirect cost. for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. saas companies, especially small. Average G&A Rate For Small Business.

From www.creditrepair.com

What is the average personal loan interest rate? Average G&A Rate For Small Business One pool and rate can. In allocating the g&a indirect cost. grant thornton is pleased to provide our 2017 government contractor survey. General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. The report presents a wealth of financial and. even within the same industries, we find measurable gaps in g&a. Average G&A Rate For Small Business.

From www.commerceinstitute.com

What Percentage of Small Businesses Fail Each Year? (2022 Data) Average G&A Rate For Small Business In allocating the g&a indirect cost. The report presents a wealth of financial and. for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. One pool and rate can. for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. even within the same. Average G&A Rate For Small Business.

From www.allbusinesstemplates.com

免费 Product Rate Sheet 样本文件在 Average G&A Rate For Small Business The report presents a wealth of financial and. One pool and rate can. general and administrative (g&a) expenses are grouped together into an overall g&a pool. grant thornton is pleased to provide our 2017 government contractor survey. In allocating the g&a indirect cost. for starters, please fine below tables of indirect cost rate calculations for a typical. Average G&A Rate For Small Business.

From www.bdcloan.com

SBA 504 Loan Program, Business Development Corporation, Small Business Average G&A Rate For Small Business In allocating the g&a indirect cost. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. for small business service providers, two indirect rates (overhead and g&a) are usually sufficient. One pool and rate can. General and administrative (g&a) expenses are expenses that are unrelated to. Average G&A Rate For Small Business.

From bdcloan.com

SBA 504 Loan Program, Business Development Corporation, Small Business Average G&A Rate For Small Business for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. general and administrative (g&a) expenses are grouped together into an overall g&a pool. even within the same industries, we find measurable gaps in g&a spending among competitors—as much as. In allocating the g&a indirect cost.. Average G&A Rate For Small Business.

From www.braintree.gov.uk

Page 1 Your guide to Business rates guide brochure 2022/23 Average G&A Rate For Small Business saas companies, especially small businesses that are scaling quickly, often have general and administrative. even within the same industries, we find measurable gaps in g&a spending among competitors—as much as. In allocating the g&a indirect cost. General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or function. grant thornton is pleased. Average G&A Rate For Small Business.

From advisorsmith.com

What Percentage of Small Businesses Fail? AdvisorSmith Average G&A Rate For Small Business grant thornton is pleased to provide our 2017 government contractor survey. In allocating the g&a indirect cost. general and administrative (g&a) expenses are grouped together into an overall g&a pool. even within the same industries, we find measurable gaps in g&a spending among competitors—as much as. One pool and rate can. General and administrative (g&a) expenses are. Average G&A Rate For Small Business.

From www.visme.co

Business Graphs 5 MustHave Data Visualizations for B2B Execs Average G&A Rate For Small Business for starters, please fine below tables of indirect cost rate calculations for a typical business using the three rate system,. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. General and administrative (g&a) expenses are expenses that are unrelated to a specific business unit or. Average G&A Rate For Small Business.

From www.youtube.com

Rates and Unit Rates (Part 2) More Rates and Unit Rates Examples Average G&A Rate For Small Business saas companies, especially small businesses that are scaling quickly, often have general and administrative. for instance, according to a mckinsey & company report, g&a expenses are between 3% and 5% of the company revenue for top. grant thornton is pleased to provide our 2017 government contractor survey. even within the same industries, we find measurable gaps. Average G&A Rate For Small Business.